Updated October 5, 2023

Understanding Your Investing Time Horizon

Understanding Your Investing Time Horizon

Understanding Your Investing Time Horizon

Mike Zaccardi, CFA, CMT

Investing Master Class

What’s your money’s purpose? Is it there to help you reach financial independence sooner? Are you simply saving up for a fun trip a few months down the road? Maybe you’re a super saver, socking away every last dime you can to grow your nest egg as fast as possible. We find that many young people want to pay down debt while saving up for a down payment on a house is a common goal. At the same time, they want to earn a high return in the stock market.

Recognizing Your Money Time Horizons

Do you notice something about all those financial objectives? Each has a unique time horizon. Identifying when you plan to spend your cash is one of the most important steps when figuring out how you should invest, and it is a cornerstone to fostering financial wellness.

For example, if a vacation abroad is on your mind, then you wouldn’t want to invest it all in the stock market since that would be too risky. On the other hand, if you are simply investing for the long haul in your 401(k) or Individual Retirement Account (IRA), then you would absolutely want to look at stock-heavy choices since you can weather Mr. Market’s ups and downs.

Balancing Risk & Reward

Aligning your portfolio allocations with your specific goals and time horizons is critical to mastering your money. A “time horizon” simply refers to the length of time you plan to hold a certain investment before you use the funds. Depending on whether your goal is short-term or long-term, your investment strategy should be tailored to maximize returns while taking on the appropriate amount of risk. Let’s run through some common situations all designed to help you understand how you should invest based on each of your goals.

Short-Term Goals: Less Than 1 Year

Your grocery budget, monthly loan repayments, and your emergency fund or rainy day account are all in this bucket. The big thing here is maintaining liquidity, which is financial mumbo-jumbo for simply having easy access to your cash when you need it. These days, it is no easy task to manage all these responsibilities at once.

A great option is to park your cash in a high-yield account, such as Allio’s high-yield portfolio, which sports one of the best rates you’ll find. Unlike a typical savings account, Allio’s account consists of stable Treasury bills, which usually yield more than savings accounts at a big bank. Cash for short-term goals must be on the ready, too. If you cannot access your money without going through a bunch of hoops or paying big fees, then run away!

Short-Term Goals: The Pros & Cons

Capital preservation and maintaining liquidity are paramount for short-term money needs. Focus on low- or zero-risk investments, not shooting for the moon with high returns. The good news is that with today’s higher interest rates available, you can earn a solid yield without putting your money at risk. Of course, the downside is that you must forgo possible strong stock market returns and there’s a risk that if inflation kicks up, then you might lose purchasing power. By keeping a solid plan for your near-term liquidity needs, you can also use credit more wisely and build your credit score.

Medium-Term Goals: More Than 1 Year, Less Than 5-7 Years

So this is the tricky area. It’s usually easy to plan out how much money you’ll need over the course of a year through budgeting. Also, ensuring your cash flow is enough to meet financial obligations within 12 months, along with keeping an adequate amount of cash in safekeeping, is relatively straightforward. But when it comes to funding intermediate-term and discretionary objectives, such as buying a new car or saving up for a master’s degree in a few years, a more balanced approach is recommended. That means investing in stocks, bonds, and other assets.

The good news is that you can do that super quick and at a modest cost through a portfolio geared toward your risk tolerance. While safety is certainly a priority, you have some wiggle room to aim for growth to earn higher returns. What's more, you can use diversification techniques to your advantage – that just means owning a basket of investments that have some that zig while others zag, helping to reduce overall portfolio volatility. This strategy can offer better returns than a high-yield account without taking on too much risk.

Medium-Term Goals: The Pros & Cons

A time horizon of a few years offers you the chance to roll the dice, albeit in a responsible way. Also, many goals beyond a year are flexible in that if your investment doesn’t perform up to snuff, then you can always increase your savings rate or delay a nice-to-have purchase like that fancy set of wheels or an adventurous trip around the world.

Maybe the toughest part is pinpointing when you will use your money and when to tone down your risk level. After all, at some point, a medium-term goal turns into a short-term goal (or even a need). That’s why developing a financial plan can be so helpful as you navigate your money journey.

Long-Term Goals: Beyond 5-7 Years

We give a range to what makes a time horizon “long-term” in nature. That’s because there is no one-size-fits-all solution here. We find that some people are more risk-averse while others are natural gamblers. Still, long-term stock market data clearly shows that returns for those willing to stick it out five years almost always see gains.

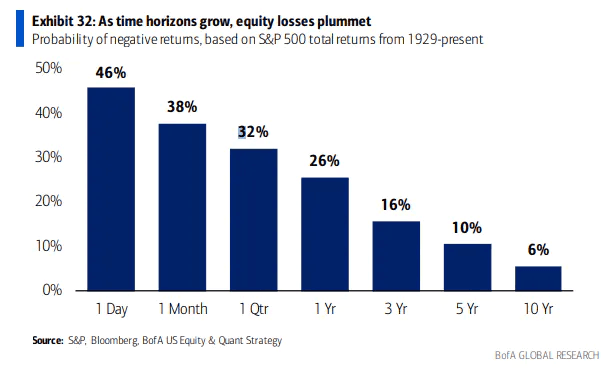

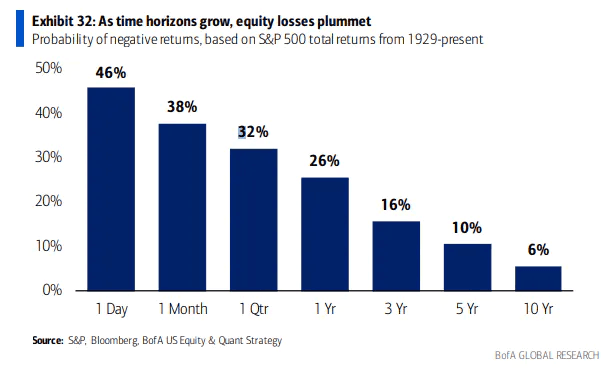

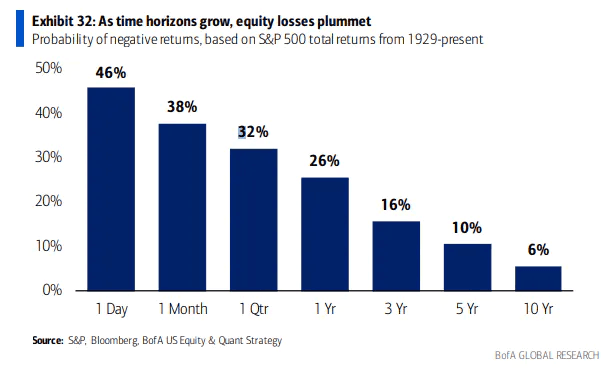

Consider that you have basically a 50/50 chance of earning a positive return in the S&P 500 on any given day. Those are not great odds, but if you stretch out your time horizon to five years, then your win rate is an attractive 89%. Furthermore, investing in stocks for the long run is so appealing since the S&P 500 has never experienced a loss over a 20-year period, according to data going back to 1926.

Time is on Your Side as a Long-Term Investor

Source: BofA Global Research

Long-Term Goals: The Pros & Cons

Time is your best friend if you hold a long-term perspective. You have the advantage in that you can ignore near-term drops in the stock market and use those dips as valuable buying opportunities. In fact, you should view stock market crashes like clearance sales – you can scoop up more shares of stocks and funds with the same amount of cash. That strategy of regular investing has the power to create massive sums of wealth over the decades. The key is to keep your cool when everyone else (including the Wall Street ‘experts’) is losing their minds. The biggest drawback to long-term investing is both your behavior and the reality that you must delay gratification for years or even decades.

The Bottom Line

Cash you need in the next 12 months should not be invested the same way as assets in your retirement account. Keeping money on hand in a high-yield portfolio that is guaranteed is crucial. Other pieces of your financial pie can take advantage of compounding via higher-risk, higher-reward investments. This strategy of bucketing helps investors of all ages determine their time horizons so that better financial decisions are made. Allio’s team encourages you to align your investment strategy with your goals and prioritize safety and liquidity for short-term needs.

What’s your money’s purpose? Is it there to help you reach financial independence sooner? Are you simply saving up for a fun trip a few months down the road? Maybe you’re a super saver, socking away every last dime you can to grow your nest egg as fast as possible. We find that many young people want to pay down debt while saving up for a down payment on a house is a common goal. At the same time, they want to earn a high return in the stock market.

Recognizing Your Money Time Horizons

Do you notice something about all those financial objectives? Each has a unique time horizon. Identifying when you plan to spend your cash is one of the most important steps when figuring out how you should invest, and it is a cornerstone to fostering financial wellness.

For example, if a vacation abroad is on your mind, then you wouldn’t want to invest it all in the stock market since that would be too risky. On the other hand, if you are simply investing for the long haul in your 401(k) or Individual Retirement Account (IRA), then you would absolutely want to look at stock-heavy choices since you can weather Mr. Market’s ups and downs.

Balancing Risk & Reward

Aligning your portfolio allocations with your specific goals and time horizons is critical to mastering your money. A “time horizon” simply refers to the length of time you plan to hold a certain investment before you use the funds. Depending on whether your goal is short-term or long-term, your investment strategy should be tailored to maximize returns while taking on the appropriate amount of risk. Let’s run through some common situations all designed to help you understand how you should invest based on each of your goals.

Short-Term Goals: Less Than 1 Year

Your grocery budget, monthly loan repayments, and your emergency fund or rainy day account are all in this bucket. The big thing here is maintaining liquidity, which is financial mumbo-jumbo for simply having easy access to your cash when you need it. These days, it is no easy task to manage all these responsibilities at once.

A great option is to park your cash in a high-yield account, such as Allio’s high-yield portfolio, which sports one of the best rates you’ll find. Unlike a typical savings account, Allio’s account consists of stable Treasury bills, which usually yield more than savings accounts at a big bank. Cash for short-term goals must be on the ready, too. If you cannot access your money without going through a bunch of hoops or paying big fees, then run away!

Short-Term Goals: The Pros & Cons

Capital preservation and maintaining liquidity are paramount for short-term money needs. Focus on low- or zero-risk investments, not shooting for the moon with high returns. The good news is that with today’s higher interest rates available, you can earn a solid yield without putting your money at risk. Of course, the downside is that you must forgo possible strong stock market returns and there’s a risk that if inflation kicks up, then you might lose purchasing power. By keeping a solid plan for your near-term liquidity needs, you can also use credit more wisely and build your credit score.

Medium-Term Goals: More Than 1 Year, Less Than 5-7 Years

So this is the tricky area. It’s usually easy to plan out how much money you’ll need over the course of a year through budgeting. Also, ensuring your cash flow is enough to meet financial obligations within 12 months, along with keeping an adequate amount of cash in safekeeping, is relatively straightforward. But when it comes to funding intermediate-term and discretionary objectives, such as buying a new car or saving up for a master’s degree in a few years, a more balanced approach is recommended. That means investing in stocks, bonds, and other assets.

The good news is that you can do that super quick and at a modest cost through a portfolio geared toward your risk tolerance. While safety is certainly a priority, you have some wiggle room to aim for growth to earn higher returns. What's more, you can use diversification techniques to your advantage – that just means owning a basket of investments that have some that zig while others zag, helping to reduce overall portfolio volatility. This strategy can offer better returns than a high-yield account without taking on too much risk.

Medium-Term Goals: The Pros & Cons

A time horizon of a few years offers you the chance to roll the dice, albeit in a responsible way. Also, many goals beyond a year are flexible in that if your investment doesn’t perform up to snuff, then you can always increase your savings rate or delay a nice-to-have purchase like that fancy set of wheels or an adventurous trip around the world.

Maybe the toughest part is pinpointing when you will use your money and when to tone down your risk level. After all, at some point, a medium-term goal turns into a short-term goal (or even a need). That’s why developing a financial plan can be so helpful as you navigate your money journey.

Long-Term Goals: Beyond 5-7 Years

We give a range to what makes a time horizon “long-term” in nature. That’s because there is no one-size-fits-all solution here. We find that some people are more risk-averse while others are natural gamblers. Still, long-term stock market data clearly shows that returns for those willing to stick it out five years almost always see gains.

Consider that you have basically a 50/50 chance of earning a positive return in the S&P 500 on any given day. Those are not great odds, but if you stretch out your time horizon to five years, then your win rate is an attractive 89%. Furthermore, investing in stocks for the long run is so appealing since the S&P 500 has never experienced a loss over a 20-year period, according to data going back to 1926.

Time is on Your Side as a Long-Term Investor

Source: BofA Global Research

Long-Term Goals: The Pros & Cons

Time is your best friend if you hold a long-term perspective. You have the advantage in that you can ignore near-term drops in the stock market and use those dips as valuable buying opportunities. In fact, you should view stock market crashes like clearance sales – you can scoop up more shares of stocks and funds with the same amount of cash. That strategy of regular investing has the power to create massive sums of wealth over the decades. The key is to keep your cool when everyone else (including the Wall Street ‘experts’) is losing their minds. The biggest drawback to long-term investing is both your behavior and the reality that you must delay gratification for years or even decades.

The Bottom Line

Cash you need in the next 12 months should not be invested the same way as assets in your retirement account. Keeping money on hand in a high-yield portfolio that is guaranteed is crucial. Other pieces of your financial pie can take advantage of compounding via higher-risk, higher-reward investments. This strategy of bucketing helps investors of all ages determine their time horizons so that better financial decisions are made. Allio’s team encourages you to align your investment strategy with your goals and prioritize safety and liquidity for short-term needs.

What’s your money’s purpose? Is it there to help you reach financial independence sooner? Are you simply saving up for a fun trip a few months down the road? Maybe you’re a super saver, socking away every last dime you can to grow your nest egg as fast as possible. We find that many young people want to pay down debt while saving up for a down payment on a house is a common goal. At the same time, they want to earn a high return in the stock market.

Recognizing Your Money Time Horizons

Do you notice something about all those financial objectives? Each has a unique time horizon. Identifying when you plan to spend your cash is one of the most important steps when figuring out how you should invest, and it is a cornerstone to fostering financial wellness.

For example, if a vacation abroad is on your mind, then you wouldn’t want to invest it all in the stock market since that would be too risky. On the other hand, if you are simply investing for the long haul in your 401(k) or Individual Retirement Account (IRA), then you would absolutely want to look at stock-heavy choices since you can weather Mr. Market’s ups and downs.

Balancing Risk & Reward

Aligning your portfolio allocations with your specific goals and time horizons is critical to mastering your money. A “time horizon” simply refers to the length of time you plan to hold a certain investment before you use the funds. Depending on whether your goal is short-term or long-term, your investment strategy should be tailored to maximize returns while taking on the appropriate amount of risk. Let’s run through some common situations all designed to help you understand how you should invest based on each of your goals.

Short-Term Goals: Less Than 1 Year

Your grocery budget, monthly loan repayments, and your emergency fund or rainy day account are all in this bucket. The big thing here is maintaining liquidity, which is financial mumbo-jumbo for simply having easy access to your cash when you need it. These days, it is no easy task to manage all these responsibilities at once.

A great option is to park your cash in a high-yield account, such as Allio’s high-yield portfolio, which sports one of the best rates you’ll find. Unlike a typical savings account, Allio’s account consists of stable Treasury bills, which usually yield more than savings accounts at a big bank. Cash for short-term goals must be on the ready, too. If you cannot access your money without going through a bunch of hoops or paying big fees, then run away!

Short-Term Goals: The Pros & Cons

Capital preservation and maintaining liquidity are paramount for short-term money needs. Focus on low- or zero-risk investments, not shooting for the moon with high returns. The good news is that with today’s higher interest rates available, you can earn a solid yield without putting your money at risk. Of course, the downside is that you must forgo possible strong stock market returns and there’s a risk that if inflation kicks up, then you might lose purchasing power. By keeping a solid plan for your near-term liquidity needs, you can also use credit more wisely and build your credit score.

Medium-Term Goals: More Than 1 Year, Less Than 5-7 Years

So this is the tricky area. It’s usually easy to plan out how much money you’ll need over the course of a year through budgeting. Also, ensuring your cash flow is enough to meet financial obligations within 12 months, along with keeping an adequate amount of cash in safekeeping, is relatively straightforward. But when it comes to funding intermediate-term and discretionary objectives, such as buying a new car or saving up for a master’s degree in a few years, a more balanced approach is recommended. That means investing in stocks, bonds, and other assets.

The good news is that you can do that super quick and at a modest cost through a portfolio geared toward your risk tolerance. While safety is certainly a priority, you have some wiggle room to aim for growth to earn higher returns. What's more, you can use diversification techniques to your advantage – that just means owning a basket of investments that have some that zig while others zag, helping to reduce overall portfolio volatility. This strategy can offer better returns than a high-yield account without taking on too much risk.

Medium-Term Goals: The Pros & Cons

A time horizon of a few years offers you the chance to roll the dice, albeit in a responsible way. Also, many goals beyond a year are flexible in that if your investment doesn’t perform up to snuff, then you can always increase your savings rate or delay a nice-to-have purchase like that fancy set of wheels or an adventurous trip around the world.

Maybe the toughest part is pinpointing when you will use your money and when to tone down your risk level. After all, at some point, a medium-term goal turns into a short-term goal (or even a need). That’s why developing a financial plan can be so helpful as you navigate your money journey.

Long-Term Goals: Beyond 5-7 Years

We give a range to what makes a time horizon “long-term” in nature. That’s because there is no one-size-fits-all solution here. We find that some people are more risk-averse while others are natural gamblers. Still, long-term stock market data clearly shows that returns for those willing to stick it out five years almost always see gains.

Consider that you have basically a 50/50 chance of earning a positive return in the S&P 500 on any given day. Those are not great odds, but if you stretch out your time horizon to five years, then your win rate is an attractive 89%. Furthermore, investing in stocks for the long run is so appealing since the S&P 500 has never experienced a loss over a 20-year period, according to data going back to 1926.

Time is on Your Side as a Long-Term Investor

Source: BofA Global Research

Long-Term Goals: The Pros & Cons

Time is your best friend if you hold a long-term perspective. You have the advantage in that you can ignore near-term drops in the stock market and use those dips as valuable buying opportunities. In fact, you should view stock market crashes like clearance sales – you can scoop up more shares of stocks and funds with the same amount of cash. That strategy of regular investing has the power to create massive sums of wealth over the decades. The key is to keep your cool when everyone else (including the Wall Street ‘experts’) is losing their minds. The biggest drawback to long-term investing is both your behavior and the reality that you must delay gratification for years or even decades.

The Bottom Line

Cash you need in the next 12 months should not be invested the same way as assets in your retirement account. Keeping money on hand in a high-yield portfolio that is guaranteed is crucial. Other pieces of your financial pie can take advantage of compounding via higher-risk, higher-reward investments. This strategy of bucketing helps investors of all ages determine their time horizons so that better financial decisions are made. Allio’s team encourages you to align your investment strategy with your goals and prioritize safety and liquidity for short-term needs.

Ready to start building wealth, regardless of your time horizon? Allio has options for short, medium, and long-term investments. Download the app today to get started!

Related Articles

Mike Zaccardi, CFA, CMT

ETF Investment Guide: Your Roadmap to Building a Diverse and Profitable Portfolio

Explore the world of ETF investing with our comprehensive guide. Learn key strategies, terms, and tax considerations for successful portfolio management.

Mike Zaccardi, CFA, CMT

CAPM Formula Explained: Navigating the Relationship Between Risk and Return

Discover the power of CAPM in investment decisions. Learn the formula, calculate expected returns, and explore alternatives in modern portfolio management.

Mike Zaccardi, CFA, CMT

How To Build Wealth with Dividend Stocks: A Complete Guide to Smart Investing

Learn how to invest in dividends – our comprehensive guide covers strategies, risks, and the key to achieving stable financial returns.

Mike Zaccardi, CFA, CMT

ETF Investment Guide: Your Roadmap to Building a Diverse and Profitable Portfolio

Explore the world of ETF investing with our comprehensive guide. Learn key strategies, terms, and tax considerations for successful portfolio management.

Mike Zaccardi, CFA, CMT

CAPM Formula Explained: Navigating the Relationship Between Risk and Return

Discover the power of CAPM in investment decisions. Learn the formula, calculate expected returns, and explore alternatives in modern portfolio management.

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.