Updated April 11, 2023

Raymond Micaletti, Ph.D.

Macro Money Monitor

Market Recap

Stocks jumped to finish off Q1. The S&P 500 returned 3.5% in the final week of March while the Nasdaq 100 rallied 3.2%, putting the finishing touch on its best quarter since Q2 2020. Commodities came ripping back with the Goldman Sachs Commodities Index jumping nearly 5%, mainly driven by a rebound in oil. Gold was lower, though, taking a breather after a strong March amid macro uncertainty. The TIPS market edged up fractionally as interest rate volatility eased. Finally, the Real Estate sector attracted dip buyers last week – the niche was higher by more than 5%.

Core PCE came in slightly under economists’ expectations on the last day of March, and all eyes will soon focus on March CPI data due out on April 12. As it stands, year-over-year CPI is +6.0% and +5.5% ex-food and energy.

The Fed and Your Money in Q2

There’s no getting around it - the Federal Reserve remains the market’s biggest x-factor right now. Hard to believe, but the interest rate hike cycle that has taken yields from near zero on the short end of the Treasury curve a bit over a year ago to near 5% today could be almost over. That’s the new market expectation following the March FOMC gathering.

Chair Powell increased the policy rate by just a quarter point and signaled the possibility that further hikes may be limited. Still, if inflation comes in hot over the next several weeks and months, then the Fed’s hand will be forced into tightening credit conditions further to calm the rise in consumer prices, likely putting the economy into a recession.

Rates Hikes Continue. For Now.

At the last meeting, the Fed went against many institutional investors who were asking for a rate pause. Some folks concerned about how the banking crisis in March would impact future lending and credit availability even suggested a rate cut would be the prudent move. Consider that massive tightening in lending standards, some argue, amounts to upwards of 75 basis points or even a full percentage point of implied rate increases, regardless of what the Fed does. So, we are in a stricter credit environment today compared to early March, and it will be interesting to see how this new normal plays out in the Financials sector.

Inflation Remains a Key Risk Amid Banking Issues

That said, inflation is still stubbornly high. Even with modestly reassuring Personal Consumption Expenditure (PCE) data on March 31 (for the month of February), both headline and core CPI rates are way above the Fed’s comfort zone. What’s more, the new key inflation metric economists are scrutinizing, core services ex-shelter, is not coming down fast enough, to put it bluntly.

Core Services ex-Housing Inflation Holding Near Its Highs

Source: BEA, BofA Global Research

For the moment, the peak Fed Funds rate is now seen just shy of 5% by the summer. That is down from above 5.6% out in September and October as was seen before the Silicon Valley Bank and Credit Suisse sagas.

We see rates being near a top. Why is that? Due to our national debt levels and with the U.S. Dollar Index holding firm above 100, the higher yields are, the more interest the government must pay on its massive debt load, and a strong greenback stymies demand for U.S. exports. The federal government simply cannot afford to keep rates above 5% for very long.

In light of the regional banking crisis that struck in March, the stock-bond correlation finally flipped negative after a sustained period of the S&P 500 and Treasury prices moving together. That signals to us that inflation fears, while still apparent, are giving way to recession jitters.

Stock (SPY)/Bond (IEF Intermediate Treasury ETF) Correlation Turns Negative in March

Q1: Equities Rally in the Face of Uncertainty

Sounds like tons of macro risk and turmoil, right? Stocks must have been volatile and weak in the quarter amid all that? Nope.

The S&P 500 notched an impressive 7.5% return to jumpstart the pre-election year (including dividends) while the tech-heavy Nasdaq 100 launched more than 20%. Just a handful of names drove the SPX higher in Q1: Together, Apple, Microsoft, NVIDIA, Tesla, and Meta Platforms accounted for two-thirds of U.S. large caps’ total return. Commodities were lower but gold shined. Easing interest rates benefited bonds, including TIPS, but the Real Estate sector was hammered until very late in Q1 amid jitters about what commercial real estate will look like in the coming months.

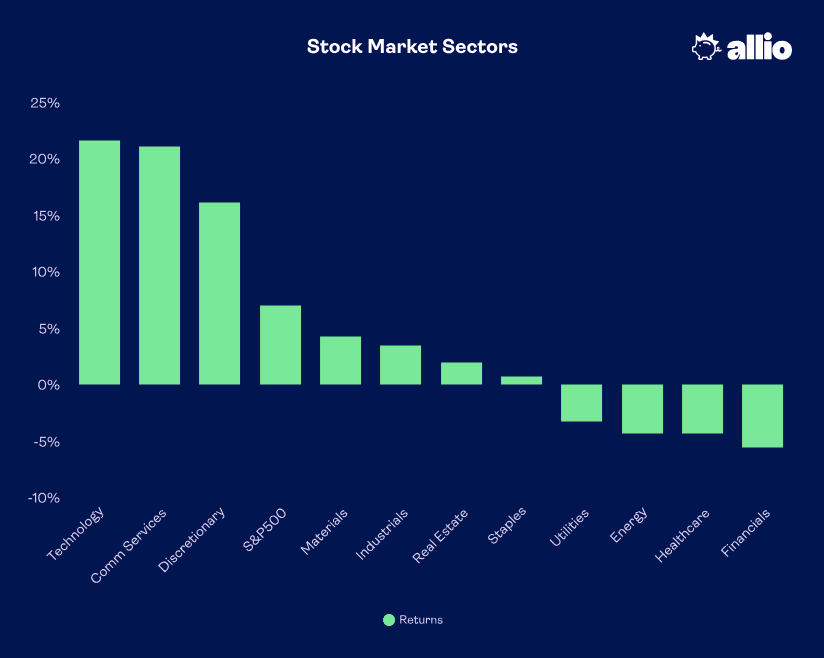

Broadly, the growth trade was in full force with Information Technology, Communication Services, and Consumer Discretionary being the only trio of sectors beating the S&P 500. The first-quarter zeitgeist was growth over value – Financials and Energy were negative. In Europe, there was particularly impressive price action with the EURO STOXX 50 notching fresh 52-week highs.

Growth Sector Lead the S&P 500 Higher in Q1

Bears Caught Offsides to Start 2023. What Will the Second Quarter Hold?

Looking ahead to Q2, the bulls have clearly gained momentum. And that makes sense given how light so many big investors were coming into 2023 following the market’s low back on October 13 last year. It’s like everyone was on the same side of the stock teeter-totter. Naturally, the market’s “pain trade” was a return to growth over value that we became accustomed to back in the 2010s and immediately after the COVID crash three years ago.

Relative sentiment (i.e., the sentiment of institutions compared to retail investors) was bullish near the Q4 lows as institutions were accumulating shares in the face of negative news flow while retail investors were too scared to invest. That dismal view and bearish positioning among small retail investors foreshadowed the strength seen so far in 2023.

Eyeing the Charts

So, the question now is: How high will the market run? Putting on our chartist hat, it is hard to argue with the strength of the Nasdaq 100’s technicals. The index is perched above 13,000 after flirting with a breakdown below 10,000 at times last year. But a series of higher lows and higher highs off the October nadir signals price strength that’s going on six months now.

Based on our chart analysis, there could be another 6% to 8% of upside from here. Investors, including the bears, must acknowledge that April of a pre-election year is a sweet spot for a continued rally. Since 1950, the S&P 500 has been up 17 of 18 pre-election year Aprils. Also, equities often continue to perform well following two strong quarters coming off of bear markets. Given that bullish backdrop and continued soft allocations to the tech sector, we expect the growth pain trade to press on and for defensive areas to be a bit weak.

S&P 500 Often Shines in April of Pre-Election Years

Source: Carson Group

Opportunities in Energy?

There is a caveat, though. We find that investment managers are heavily short the Energy sector, too. Now that the front month of WTI crude oil has rallied big after a brief drop under $70, the time could be ripe for cyclical stocks in Energy to come back to life. Moreover, if the Fed takes a pause, that could reignite the entire commodities and Energy sector complex. Our strategic holdings are positioned to benefit from that market outcome.

Is the Financials Sector On Sale?

Speaking of market outcomes, perhaps the most uncertainty is seen in the Financials sector in light of a rekindling of the 2008 Great Financial Crisis feeling. Investors seem to think that policymakers averted disaster with their coordinated efforts to backstop depositors and offer added liquidity to the system, but it is still unknown how banks will do amid stricter lending conditions and with a yield curve that remains inverted.

Allio is being nimble in the space, not placing large wagers at this time. A relief rally in bank stocks could be the story at the start of Q2 but following the Financials sector’s earnings period that kicks off later this month, the group may end the quarter on a weak note.

Our View

We continue to like owning the Nasdaq and growth companies through the second quarter while the commodities complex and Energy sector appear increasingly attractive. Allio is window shopping in the Financials sector right now, but this will likely be more of a tactical play given heightened uncertainty and the group’s relative underperformance lately.

Something else to ponder: Do you have too much cash on the sidelines? Many folks do. The final three weeks of Q1 featured massive inflows into money market mutual funds at both the institutional and retail levels. Yields north of 4% indeed feel safe in the short run when volatility is high, but the hard part is getting back into equities in a disciplined way. Cash likely won’t beat inflation materially over the long haul. For the stock market, rising dry powder in money markets ends up being a future bullish catalyst.

Giant Money Flows into Money Market Funds So Far in 2023

Source: EPFR, Goldman Sachs

The Bottom Line

Institutions have stepped up their buying in 2023. That tailwind for the bulls helped lift stocks in Q1, but all eyes remain on how the Fed navigates a volatile banking landscape. We will monitor inflation readings in the weeks ahead before the May FOMC meeting along with other key macro developments. We foresee momentum as the bulls’ friend in the short term with the tech trade continuing to work.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.