Updated October 12, 2023

Mike Zaccardi, CFA, CMT

Personal Finance

Credit scores are important for all consumers so they can secure favorable borrowing rates and have access to capital when they need it. There are several factors that go into determining your credit score – knowing them will arm you with the tools necessary to build a solid credit profile. You can view your credit score and history for free through several websites and even via your credit card company. If your credit score isn’t the best right now, have no fear – we'll outline ways to improve your credit.

At Allio, it’s our mission to help all people achieve financial wellness. Part of sound personal finance is understanding all that goes into a credit score so you can get on the fast track toward financial independence.

Why Do We Have Credit Scores?

Credit scores range from 300 to 850. For perspective, the average FICO score is 716 as of August 2022. A credit score acts as a gauge to a lender of how reliable a potential borrower is. Credit scores are important so that lenders can have a sense of the riskiness of borrowers. But how did these scores even come about?

It dates back to the middle of the 19th century when commercial merchants sought to research the quality of would-be business borrowers. The Mercantile Agency, founded in 1841, was the first real commercial credit reporting agency. The group performed financial background checks on both lenders and borrowers. Being a new service, there wasn’t much in the way of standardization of its analysis methods. By the late 1800s, though, credit reporting garnered more traction with retailers, and the focus soon shifted to the individual consumer.

Credit scores came into the mainstream during the 1960s as technology allowed for better tracking of all the data. It was a slow adoption from tracking consumers’ information on paper in filing cabinets to getting it housed on a computer. It was also a messy process as hundreds of credit reporting agencies cropped up. The industry consolidated, and soon just five major bureaus dominated the credit scoring landscape.

Fast-forward to today, and there are three major credit reporting agencies: Experian, TransUnion, and Equifax. The most widely cited credit scores are the FICO score (created by the Fair Isaac Corporation, now just FICO) and the lesser-used Vantage score. While there are two primary scores, both feature similar calculations and will generally move together.

What Does My Credit Score Mean?

Stepping out of the history classroom and into what your credit score means for your personal finances, the simplest thing to know about the score is the higher the better! A solid credit history means you can secure the lowest possible mortgage, auto loan, and other consumer borrowing rates. It’s said that some employers even peek at credit profiles when assessing job candidates. It is a big deal.

According to Equifax, there are several credit bands to know about.

Excellent (800-850): These are the top echelon borrowers. They have a pristine payment history and a long track record of paying bills on time. Those with scores in the 800s also rarely use up too much of their available credit. Boosting their scores is a diverse mix of credit types.

Very Good (740-799): Are you not quite in the top tier? No problem! Simply having a score in the “very good” range will grant you access to some of the best borrowing rates on the market.

Good (670-739): Those with a score under roughly 700 have some work to do, but with just a bit of effort, you can see your score rise to the next level within a few months.

Fair (580-669): Many young borrowers who perhaps missed a payment or used up too much of their available credit likely find themselves with just a ‘fair’ score. We’ll go through some tips later on how to beef up your score.

Poor (300-579): Those with a bad score are considered “subprime” borrowers and will not qualify for most credit cards. You might even pay more for auto insurance. A low score is not a reflection of who you are as a person though. Always remember that with personal finance. You can get on the road to success with some knowledge and a game plan!

What Factors Go into a Credit Score?

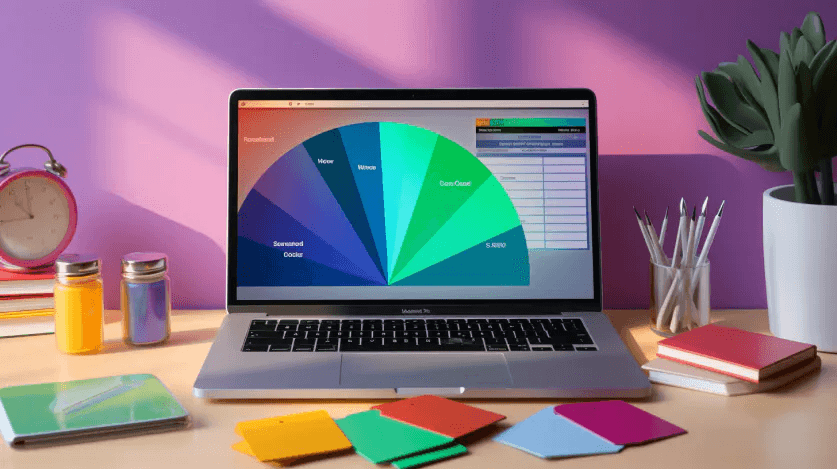

According to myFICO, there are five pieces of the credit score pie:

Payment History (35%)

Amounts Owed (30%)

Length of Credit History (15%)

Applications for New Credit (10%)

Credit Mix (10%)

Understanding all that goes into what determines a credit score is a key first step to either maintaining a solid score or working to improve it.

The biggest score determinant is your payment history with a 35% weight. That’s actually great news – it means that all you need to ensure is that you pay your bills on time. A late payment is considered one that’s 30 days or more past the due date. Over the course of several months to a few years, you will likely see your FICO score rise if your bill-pay history is sound. The other key metric is how much you owe relative to your available credit which determines 30% of your score.

How Do I See My Credit Score?

By now you probably want to know what your score is. You can check as soon as you're done reading the whole article! It used to be that seeing your credit score was a costly and tedious process. Today, though, there are sites that allow you to check your score as frequently as each day. CreditKarma.com is one such site that grabs your score from Equifax and TransUnion, but that is a “VantageScore 3.0” figure, not the more widely used FICO score. It still gives consumers a sense of where they stand.

If you have a major credit card, then you might have access to view your FICO score. Discover, Citi, American Express, and Bank of America offer that benefit to cardholders. Moreover, many credit unions allow members to see their scores.

A word of caution: be careful not to request a “hard” credit pull. Doing so will ding your credit score since that is technically an application for new credit in the eyes of the credit bureaus. While that factor comprises just 10% of your score, a hard credit check is still a negative.

It’s also good to know that you can request a full credit report once per year (for free) from each of the three agencies. That means you can see your profile once every four months if you time it right.

How Can I Raise My Credit Score?

Raising your credit score is as simple as paying your bills on time, keeping total debt to available credit in check, and avoiding applying for too many new credit lines. While that seems simple on paper, it might not be so easy in real life.

Step one? Give yourself grace. Don’t beat yourself up if you have a low score and are not seeing it rise rapidly. It takes time for your hard work to pay off. The more time that passes, the better your score gets (all else equal) since the length of your credit history is the third-biggest weight in your FICO score makeup.

While paying your bills on time is intuitive, what’s often surprising to many people is that your credit score can go down by just using too much available credit. Target tapping no more than about 30% of your total available credit. The lower the better.

As you take on more debt, lenders think you are getting pressed for cash, so they become less willing to lend. What this also means is that when you close an old credit account, your score might go down since that means your total available credit is reduced. Keep those old accounts open so long as there are no annual fees.

Another tip to boost your credit score? Installment loans. This is a good option if you have cash stashed at a bank and want to use that as a backstop for a loan request. Check with your financial institution to see if they offer this service.

Want a good hack to raise your score? Hop on as an authorized user to a relative or friend with a good credit standing. Just being an authorized card user, believe it or not, can swell your score. You don’t even need to use the card. Simply having your name alongside a prime borrower does the trick.

Bad Credit, No Credit: Start Here

If you got off on the wrong financial footing, perhaps during college or as a young adult, you have a lot of company! It’s common to simply not know about good personal financial habits early in life. We all learn through mistakes. The upshot is that there are credit-building options for folks with even the poorest of scores or no credit history whatsoever.

Credit builder loans can help those in a tight credit spot. This is a type of loan, similar to an installment loan, is meant to help individuals with a limited credit history get on a solid footing. Also called “fresh start loans,” credit builder loans can also assist those with poor credit since cash is set aside in a bank account and acts as collateral for the lender. The borrower can tap the cash only when the loan is paid off, so there is a dual benefit of raising your credit score along with saving for the future. Many small banks and credit unions offer this loan type.

Secured credit cards are another popular method to repair a bad credit history. The term “secured” simply means the loan is essentially guaranteed by cash. There’s an upfront deposit required to be approved for a secured credit card, and can often be as low as a few hundred dollars.

Got Hacked? You Can Freeze Your Credit

With cyber-attacks commonplace, protecting your financial information is critical. You can sign up for credit monitoring services, which your credit card company might offer for free.

If you had your information compromised, you can freeze your credit. With a credit freeze, no new lines of credit can be opened in your name, and access to your credit reports is restricted. You’ll have to contact each of the three credit reporting agencies separately to request a freeze. Once you feel safe from scammers, you can unfreeze your credit by contacting the bureaus.

The Bottom Line

Credit scores determine how much you will pay for a mortgage, auto loan, or personal lines of credit, and can even impact a job application or getting the apartment you want. Knowing the key factors that go into calculating your FICO score is important to taking steps to improve your credit or simply to keep your score as high as possible. Paying your bills on time and not using up too much of your available credit are effective tactics.

Allio believes a bright financial future starts with a solid foundation. Having your personal financial house in order, such as your credit profile, gets you on the path to growing your money effortlessly.

Whether you’re seeking an expert team to manage your money or looking to build your own portfolios with the best financial technology available, Allio can help. Head to the app store and download Allio today!

Related Articles

The articles and customer support materials available on this property by Allio are educational only and not investment or tax advice.

If not otherwise specified above, this page contains original content by Allio Advisors LLC. This content is for general informational purposes only.

The information provided should be used at your own risk.

The original content provided here by Allio should not be construed as personal financial planning, tax, or financial advice. Whether an article, FAQ, customer support collateral, or interactive calculator, all original content by Allio is only for general informational purposes.

While we do our utmost to present fair, accurate reporting and analysis, Allio offers no warranties about the accuracy or completeness of the information contained in the published articles. Please pay attention to the original publication date and last updated date of each article. Allio offers no guarantee that it will update its articles after the date they were posted with subsequent developments of any kind, including, but not limited to, any subsequent changes in the relevant laws and regulations.

Any links provided to other websites are offered as a matter of convenience and are not intended to imply that Allio or its writers endorse, sponsor, promote, and/or are affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Allio may publish content that has been created by affiliated or unaffiliated contributors, who may include employees, other financial advisors, third-party authors who are paid a fee by Allio, or other parties. Unless otherwise noted, the content of such posts does not necessarily represent the actual views or opinions of Allio or any of its officers, directors, or employees. The opinions expressed by guest writers and/or article sources/interviewees are strictly their own and do not necessarily represent those of Allio.

For content involving investments or securities, you should know that investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Allio's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. This page is not an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where Allio Advisors is not registered.

For content related to taxes, you should know that you should not rely on the information as tax advice. Articles or FAQs do not constitute a tax opinion and are not intended or written to be used, nor can they be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer.